Mastering the Art of Cheque Writing in Canada: A Comprehensive Guide

In an age where digital payments dominate, you might be surprised to learn that cheques are still a cornerstone of Canadian commerce. Indeed, seven out of ten businesses in Canada continue to accept cheques, underscoring their enduring relevance. Whether you're a business owner or an individual managing your personal finances, knowing how to write a cheque is a crucial skill. It offers a secure way to handle transactions without exposing sensitive bank details. This comprehensive guide from goPeer Funding aims to equip you with everything you need to know about writing cheques in Canada, from understanding key terminologies to executing the process with precision and security.

The Basics of Cheques

A cheque is essentially a written, dated, and signed directive instructing a bank to pay a specified amount of money to a designated recipient. Cheques are indispensable for situations that require secure, non-digital transactions. Let's break down some essential terms you should be familiar with:

Bank Account: Your bank account is where your money is stored.

Chequing Account: A specific type of bank account designed for frequent transactions like writing cheques.

Financial Institutions: These include banks and credit unions, each offering various services and products.

Bank Branches and Online Banking: Physical locations and digital portals where you can manage your accounts and conduct transactions.

Understanding these terms will make the process of writing a cheque smoother and more efficient.

Pre-Writing Considerations

Before you even pick up a pen, it's crucial to ensure that you have sufficient funds in your account to cover the cheque amount. Overdrafts and bounced cheques can lead to hefty fees and damage your financial reputation. Different types of cheques, such as blank, void, and post-dated cheques, serve various financial needs and should be used appropriately.

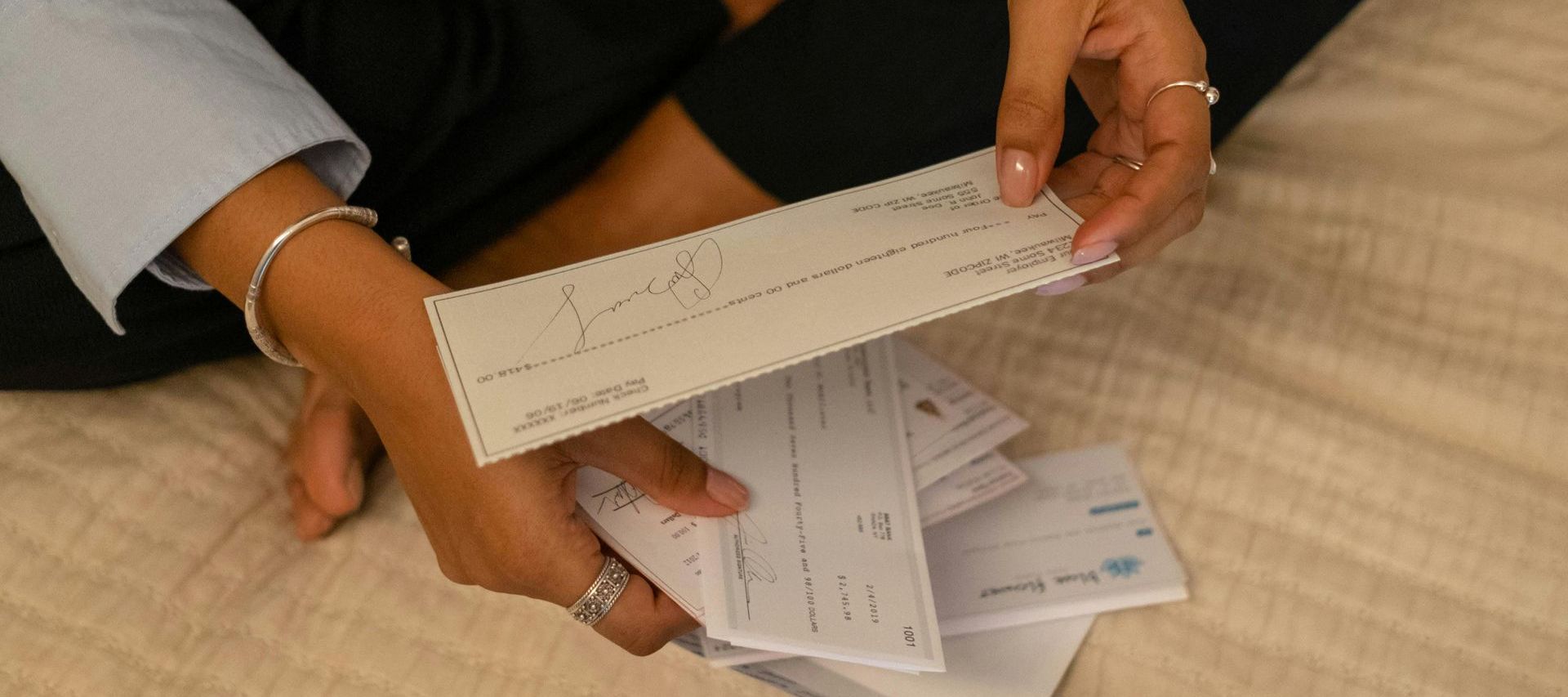

Step-By-Step Guide to Writing a Cheque

Writing a cheque in Canada involves several specific steps, each designed to ensure accuracy and security. Here’s a detailed breakdown:

Date Line: Write the current date or a future date if you are post-dating the cheque. This is crucial for timing the transaction.

Payee Line: Clearly write the name of the individual or business that will receive the cheque. Using capital letters can help avoid alterations.

Amount in Numbers: Fill in the exact amount of money you are paying in numerical form.

Amount in Words: Write the same amount in words to confirm the payment amount. This is a crucial step to prevent fraud.

Memo Line: This section is optional, but you can use it to note the purpose of the cheque.

Signature Line: Your signature authorizes the cheque. Make sure it matches the one on file with your bank to avoid complications.

Precision in each of these sections is vital. A single mistake can render the cheque invalid or expose you to fraud risks.

Special Types of Cheques

Understanding the different types of cheques can help you use them appropriately:

Personal Cheques: These are issued by individuals and are commonly used for personal transactions.

Bank Cheques: Also known as cashier's cheques, these are issued by banks and are considered more secure as the bank itself guarantees the payment.

Effective Cheque Management

Once you've written a cheque, managing it effectively is the next step. Record the details in a cheque register to keep track of your transactions. Reconcile your cheques with your bank statements to ensure there are no discrepancies. Remember, cheques are generally valid for six months. After this period, they become stale-dated and are no longer negotiable.

Security Measures

Security cannot be overstated when it comes to cheques. Here are some measures to help you avoid scams:

Verify Cheque Sources: Ensure that the cheque you receive is from a legitimate source.

Use Indelible Ink: This type of ink is resistant to tampering.

Keep Chequebooks Secure: Store your chequebooks in a safe place to prevent unauthorized access.

Alternatives to Cheques

While cheques remain essential, there are several modern alternatives for managing finances:

Online Payments: Quick and convenient, ideal for everyday transactions.

Electronic Transfers: Secure and efficient for both personal and business needs.

Direct Deposits: Perfect for regular payments such as salaries and pensions.

These alternatives provide a balanced approach to financial management, complementing the traditional use of cheques.

Conclusion

In conclusion, mastering the art of writing a cheque in Canada is a valuable skill that combines tradition with modern financial practices. By understanding the basics, following a meticulous step-by-step process, and taking necessary security measures, you can ensure that your financial transactions are both secure and efficient. Whether you choose to stick with traditional cheques or explore digital alternatives, a balanced approach will serve you well in managing your finances responsibly.